Hoping for a Successful Business Exit?

Let us help you achieve it

98% of business owners don’t know the value of their business. Yet 9 out of 10 owners expect their business to fund the majority of their retirement. You owe it to yourself to find out what your business is worth. Knowing the value of your business will ultimately determine your retirement lifestyle.

Take our free assessment to uncover key factors driving the growth and success of your business

Legacy Business Advisors

Offering Successful Exit Tools

Learn more from our helpful blogs, podcast, informative E-books and newsletter.

LEGACY BLOG

PODCAST

E-BOOKS

Our Services

Needs Analysis

Want to know what your retirement will look like? By providing an understanding of what your business is worth and a plan for extracting that value through your preferred transition strategy, we will present a realistic future income scenario. That scenario incorporates your existing personal assets into a comprehensive picture of what you can expect your assets to generate in retirement to achieve your goals.

Plan Design and Execution

After identifying your personal and business goals, we work collaboratively with your existing team of advisors to design a plan proving the best chance for a successful outcome. Success will be measured by your objectives — by identifying these in advance, all of your advisors will work cohesively to structure a transition plan narrowly tailored to achieve your goals.

Ongoing Peer Group Support

Transitions do not happen overnight. It’s long term process that requires your attention and commitment. Our affiliation with TAB Western Reserve provides the assistance you need to stay on track with ongoing support that includes peer to peer advisory boards. Peer boards consist of business owners who face many of the same issues as you, and who are there to help keep you accountable to your plan.

Legacy Business Advisors incorporates next level advisory services using the Capitaliz platform. Our Cap Accredited advisors are ready to build your business value.

What’s Next

Why Have a Plan?

When you started your business, your focus was appropriately on the next sale or next week’s overhead. Taking a vacation– or leaving your business for any amount of time was probably the last thing on your mind, and rightfully so. Now that you can spend more time enjoying the fruits of your labor, your focus turns to what comes next.

With the same care it took to build your business, the next chapter needs the same thoughtful planning.

Why Plan Now?

You’re not alone. Baby boomers like you own more than 12 million businesses. In the next 10-years, it’s estimated that 70% of those businesses will be sold. Supply could outweigh demand.

More than $40 trillion of assets reside in those small businesses. If you’re like most business owners, your assets are tied to your companies day-to-day operations.

If you can’t exit your business and Tap these assets, how will you retire?

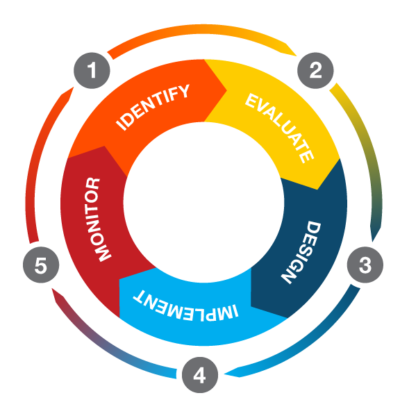

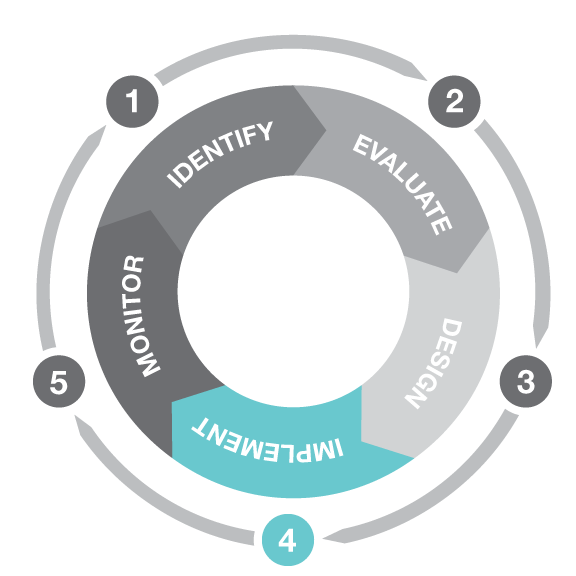

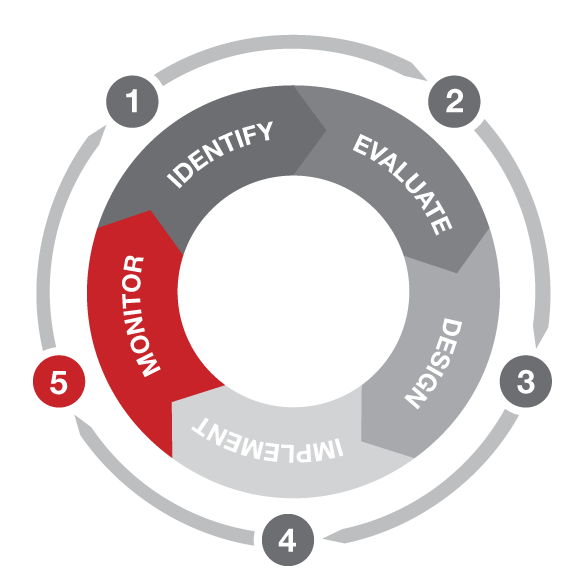

Our Five-Phase Process

Legacy Advisors has set a standard that everyone else in the business should aspire too. Truly, it is ‘best in class.’

–Bo Burlingham, Author, Finish Big: How Great Entrepreneurs Exit their Companies on top

Mark Dorman and Bo Burlingham

“Mark Dorman and his team at Legacy Advisors has created the best model I’ve seen for providing business owners with the advice and support they need to develop a sound transition plan and maximize their chances of winding up happy, at peace and financially secure at the end of the process. By putting together three essential elements – financial needs analysis, counseling on plan design and execution, and ongoing support through peer groups – Legacy Advisors has set a standard that everyone else in the business should aspire to. Truly, it is ‘best in class.'”

Ask Us - We Can Help!

Get helpful information you need in your in box

Legacy Business Advisors is committed to delivering up-to-date and informative news and information about how to achieve a successful exit. Sign up for our quarterly newsletter to hear first hand from our experts and your fellow small business owners how to orchestrate your perfect transition.

Contact

Legacy Business Advisors

Office: 330-350-5419

Fax: 330-722-3115

1093 Medina Road, STE 201

Medina, OH 44256